prince william county real estate tax assessment

For example if the total tax rate were 12075 per 100 of assessed value then a property with an assessed value of 300000 dollars is calculated as. Click here to register for an account or here to login if you already have an account.

Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia.

. Report a Vehicle SoldMovedDisposed. No products in the cart. Submit Consumption Tax Return.

300000 100 x 12075 362250. 8893 Mcnair Dr Alexandria VA 22309. Search Any Address 2.

Relief of personal property tax and vehicle license fee. Prince William County Virginia Home. Enter your payment card information.

Pro club long sleeve white. By creating an account you will have access to balance and account information notifications etc. Save View Detail Similar Properties.

Prince William County accepts advance payments from individuals and businesses. Radford university nursing tuition prince william county tax. Then they get the assessed value by multiplying the percent of total value assesed currently 100.

Enter jurisdiction code 1036. You can pay a bill without logging in using this screen. They are a valuable tool for the real estate industry offering.

Report High Mileage for a Vehicle. Search homes for sale in Prince William County VA for free. View all 4 listings available in Prince William County with an average price of 265129.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Submit Transient Occupancy Return. The Commissioner is responsible for maintaining real estate ownership records assessing all.

Press 1 to pay Personal Property Tax. Posted on January 17 2016. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

If you have questions about this site please email the Real Estate Assessments Office. Prince William County Property Tax Free PDF eBooks. See Property Records Tax Titles Owner Info More.

Request a Filing Extension. Dial 1-888-2PAY TAX 1-888-272-9829. Enter the house or property number.

Press 2 to pay Real Estate Tax. Use both House Number and House Number High fields when searching for range of house numbers. Prince william county tax.

Prince William County Real Estate Assessor 4379 Ridgewood Center Drive Suite 203 Prince William Virginia 22192 Contact Info. Then they multiply that by the tax rate to get your property tax. You can read more at Propety Taxes in Prince William County Virginia.

They are maintained by various government offices in Prince William County Virginia State and at the Federal level. If you assume tobacco was 2d per pound then the tax rate in Prince William County would be. Prince william county tax 12052022.

Prince william county property tax records. Advance payments are held as a credit on your real estate personal property or business tax account and applied to a future tax bill when the tax rate and assessment are set or when you file your business tax return. Submit Business Tangible Property Return.

Posted on May 12 2022 by. Prince william county tax. Enter the Account Number listed on the billing statement.

Prince William County collects on average 09 of a propertys assessed fair market value as property tax. Telephone Payments Have pen and paper at hand. Ad Find All The Assessor Records You Need In One Place.

You can call the Prince William County Tax Assessors Office for assistance at 703-792-6780. Submit Daily Rental Return. 1759 - 104 pounds tobacco1250 pounds per annual crop 83 tax rate 1760 -.

Daily Rental Tax Heavy Equipment Rental Business 15 of the gross proceeds arising from rental of heavy equipment property. The real estate tax is paid in two annual installments as shown on the tax calendar. Daily Rental Tax Short Term Rental Business 1 of the gross proceeds arising from rental of tangible personal property.

These records can include Prince William County property tax assessments and assessment challenges appraisals and income taxes. 3100 County Avg 5900. 703 792 6780 Phone The Prince William County Tax Assessors Office is located in Prince William Virginia.

18502 Corby Street 399000. Prince William County Real Estate. Visit Our Website Today.

Please call the assessors office in Prince William before you send documents or if you need to schedule a meeting. Hi the county assesses a land value and an improvements value to get a total value. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

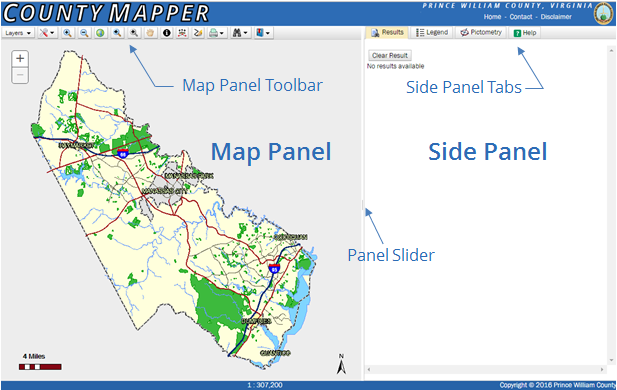

Step-by-step instructions are displayed from the website. Prince William County Real Estate Assessments Office 703 792-6780 Metro 631-1703 ext. Effective tax rate Prince William County 00105 of Asessed Home Value Virginia 00082 of Asessed Home Value National 00114 of Asessed Home Value Median real estate taxes paid Prince William County 4010 Virginia 2234 National 2471 Median home value Prince William County 382400 Virginia 273100 National 217500 Median income.

Get driving directions to this office Prince William County Assessors Office Services. Submit Business License Return. The tax rate is expressed in dollars per one hundred dollars of assessed value.

Prince William County - Log in. Submit Consumer Utility Return. Get Records Retrieval For Virginia Assessor Today.

Enter street name without street direction NSEW or suffix StDrAvetc. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. Transient Occupancy Tax 8 of total charge for lodging or space furnished to a transient.

Avg Taxes in Prince William County.

The Rural Area In Prince William County

Now Accepting Applications Restore Retail Grant Program

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Prince William County Park Rangers New On Call Number Effective April 1 2022

County Employees Summer Jobs Prince William County

Prince William Area Leaders Call For Reconsideration Of Route 28 Bypass Headlines Insidenova Com

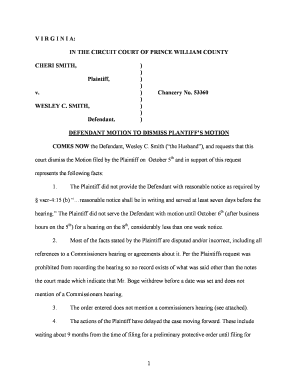

Fillable Online Liamsdad V I R G I N I A In The Circuit Court Of Prince William County Cheri Smith Plaintiff V Liamsdad Fax Email Print Pdffiller

Prince William County Warranty Deed Form Virginia Deeds Com

Data Center Opportunity Zone Overlay District Comprehensive Review

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com